Become a CeFT®

Advanced Certification in Life Transitions.

Learn a universal, repeatable process and tools for managing the human dynamics of financial change.

The Stakes Are High In Financial Transitions, When Decisions Shape Life.

We provide the mindset, tools and community to go beyond traditional training and life planning to become a Certified Financial Transitionist®.

Become a Certified Financial Transitionist®

Learn a universal, repeatable process and tools for managing the human dynamics of financial change.

Core Training

12-month Virtual Training Course

While managing money is one thing, managing major life changes is entirely different.

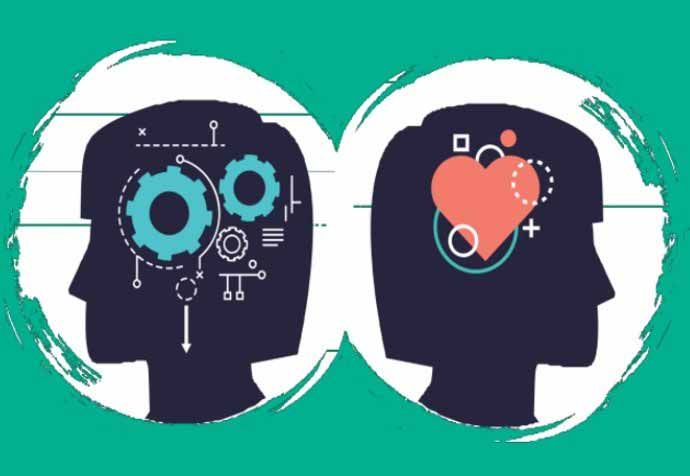

The two sides of money (technical and personal) are equally important and equally complex. The personal side drives decisions, especially during life transition events.

Traditional training covers the technical side, while the FTI provides equally important and complex training on the personal side of life transitions.

Next session - March 17, 2026, at 1:00 pm EST

LEARN MORE...We Believe There Are Two Sides to Money

The technical side and the personal side.

Both sides are equally important and complex, but it is the personal side that drives decision-making.

What Our Members Say

Have any Questions?

📧 Email info@financialtransitionist.com